Your Guide to Financing — Post-COVID-19

It’s still a great time to buy or build a home, despite the level of uncertainty that the COVID-19 pandemic has brought to our everyday lives.

Due to record low interest rates, relatively affordable house prices, generous government grants—and, more recently: looser lending restrictions for everyday Australians.

With these favourable market conditions, there has never been a time in history when buyers have had such a unique opportunity to buy.

If you’re a first-home buyer, purchasing in the area you’ve always wanted is more feasible than ever, especially with a good supply of suitable properties on the market. The same is true if you’re considering a knockdown and rebuild project or building your dream home.

And, if you’re a property investor, the 4-5% average rental yield and interest rates (that can be as low as 2.5%) present a real opportunity.

Now, let’s talk about a few financing questions you might have in mind, and answer each of them.

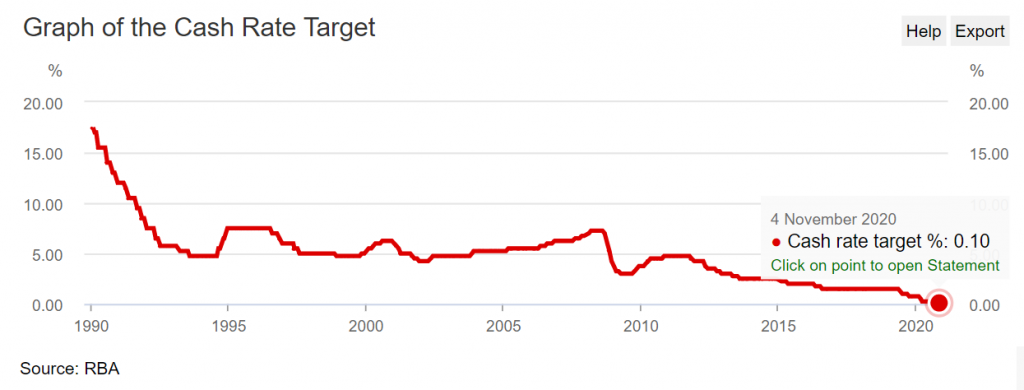

Do we expect interest rates to stay low?

By looking at the consistent data from the RBA shown above, it appears low interest rates are here to stay for many months—or even years—to come. This can provide you with peace of mind when it comes to repayments.

How much have house prices fallen?

According to CoreLogic’s national home price index, overall Brisbane showed a 0.5% rise, although there was a 0.1% fall in national prices last September 2020. Quality properties are holding their value, and are being sold for a relatively fair price.

Are house prices going to fall further?

We might see slight dips in prices as the market reacts to the ongoing COVID-19 crisis. However, forecasts look positive, given current market prices and low interest rates.

In fact, there may be sharp price increases when the pandemic eases and things start going back to normal. This is because of a huge backlog of supply and demand, which should generate plenty of activity in the market.

What government help can I get?

If you’re looking to buy your first home anywhere in Queensland, the Queensland First Home Owners’ Grant (FHOG) can give you a $15,000-incentive for buying or building your new home, valued at less than $750,000.

The Federal government has also introduced the HomeBuilder scheme, which provides a $25,000 grant to qualified Australians. While it was first announced that applications for the program will only last until the end of the year (31 December 2020), a recent update from Federal Treasurer Josh Frydenberg has implied that there could be an extension.

Will it be harder for me to get a home loan?

Not anymore.

Since Treasurer Frydenberg announced that there will be changes to the overly restrictive responsible lending rules, Australians will now be able to:

- Get timely access to credit through a simplified credit framework

- Have a more efficient flow of credit—while maintaining strong consumer protections—through changes to Australian credit laws

What is set to change in the new lending regulations?

Even though changes won’t be coming into effect until next year (1 March 2021), eventually you’ll finally be able to borrow more money, or find it easier to be approved for finance. This enables you to compete against fewer buyers, putting you in an ideal position to secure your next asset.

This also means that there will be a window of opportunity for astute investors to amplify their wealth position between now and the second quarter of 2021.

Why build with Preferred Homes?

If you’re ready to buy or build your home, Preferred Homes can help. We are HomeBuilder-compliant; and even if you don’t qualify for this grant, we will give you $25,000—in cold hard cash—if you partner with us. Get in touch with us today on 0408 788 351.